ValorConseilCalvados® vous accompagne dans votre démarche sûreté/sécurité, propriété intellectuelle, règlementation, mise en conformité.

L’une de ses expertises, conception professionnelle de systèmes mobiles autonomes sur-mesure. Véhicules aériens (UAV/UAS/drones), Véhicules terrestres et systèmes robotiques (UGV), Véhicules de surface et sous-marins (USV, AUV, UUV, ROV)). Votre solution, nous l’avons, nous l’aurons.

Experts des technologies Cloud Microsoft et Partenaire agréé Gold depuis 2009, nous adressons vos besoins de collaboration, mobilité, sécurité et résilience de données. Cet agrément, obtenu grâce à notre expertise collective, nos certifications individuelles et nos références, nous vaut la confiance de nombreuses entreprises, établissements d’enseignement et associations.

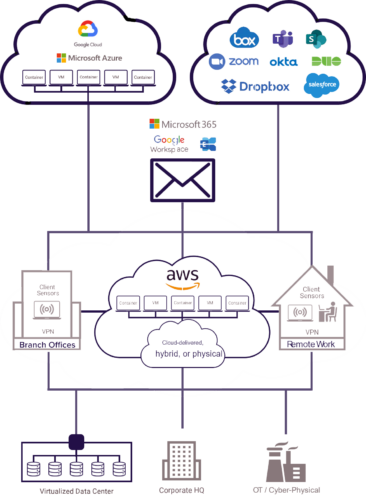

Réseau Valor a réalisé à ce jour plus d’un millier de migrations vers le Cloud. Nos clients apprécient notre savoir-faire en matière de migration de l’existant mais aussi en termes d’accompagnement pour SI et utilisateurs. TPE, PME, Professions libérales… Votre productivité est collaborative, votre patrimoine documentaire et vos communications exigent sécurité, résilience, conformité. Adapter vos habitudes au travail hybride devient incontournable et vous souhaitez cohésion et pertinence dans vos choix de solutions informatiques.

Quelle que soit la taille de votre structure, que vous soyez indépendant ou en équipe, que votre profession libérale soit réglementée ou pas, votre système d’information requiert toute votre attention -et la nôtre- pour vous permettre d’exercer votre métier en toute sérénité.

Depuis 2009, le Réseau Valor , Partenaire agréé Gold Microsoft, fort de 12 ans d’expérience, vous conseille et adapte ses réponses à vos besoins spécifiques. L’agrément Gold Microsoft, obtenu grâce à notre expertise collective, nos certifications individuelles et nos références, nous vaut la confiance de nombreuses TPE, établissements d’enseignement privés/publics et associations.

Notre mission d’expert judiciaire nous a permis d’amener nos procédures de preuve électronique et d’enquête post-mortem à être certifiées ISO9000. De plus ValorConseilCalvados® a été certifiée conforme avec la norme ISO/IEC 27001:2013 relative à la sécurité informatique, (ceci grâce à notre mécène l’9232® de CAEN avec le projet collaboratif l’9232® / UMRS® VCCAI23-QZEN®).

La cybersécurité n’est plus un problème à échelle humaine. Les organisations doivent adopter des protections basées sur l’IA, celle-ci se défendant contre les attaques de plus en plus automatisées. À une époque où les cyberattaques évoluent rapidement et où les acteurs de la menace frappent délibérément lorsque les équipes de sécurité sont absentes du bureau,

les technologies d’intelligence artificielle sont devenues essentielles pour prendre des mesures ciblées afin de contenir ces attaques sans interrompre les activités normales. La Cyber IA détecte chaque étape d’une intrusion en temps réel, sans l’utilisation de signatures ou de règles statiques. Cyber AI Analyst est la technologie d’investigation optimum, qui trie, interprète et signale automatiquement l’ensemble des incidents de sécurité.

Notre ressource en cybersécurité, des mathématiciens et des cyber experts issus d’entreprise leader de l’IA (IBM®, Microsoft®, INRIA®, …) dans le domaine de la cybersécurité. La cyber IA est rapidement devenu la technologie assez puissante pour identifier un large éventail de menaces dès leurs premières manifestations, y compris les attaques internes et l’espionnage.

Les articles les plus populaires …

Ce que nos partenaires disent de nous …

4.8 sur 5 basé sur 2989 avis | 21/02/22